Yes. Your funds remain safe and secure at all times. Accounts continue to be insured by the National Credit Union Administration for up to $250,000 per member.

As you are aware, we converted your accounts from the previous Marriott Employees’ Federal Credit Union (“MEFCU”) banking system to the USALLIANCE Financial system at the end of September 2023. All of us at USALLIANCE are thrilled to welcome all former MEFCU members into the USALLIANCE family, and we couldn’t be happier with all of the positive messages we’ve received so far!

The final piece in the conversion process will be credit cards. For the time being, your MEFCU credit card will still work, and you can access your credit card account online directly at www.ezcardinfo.com. We will provide further information later in 2024 as we prepared for the credit card conversion.

We want to make sure that all our new members have the information they need to become comfortable at USALLIANCE, so we have provided additional information as well as answers to some frequently asked questions below.

If you have further questions, please feel free to contact Member Services, who will be happy to assist you:

This important information is being provided to you by USALLIANCE Financial to help guide you through the upcoming changes to your account. These changes are a result of USALLIANCE Financial merging core operating systems with MEFCU Direct.

We ask that you please pay particular attention to the following items as we anticipate they will have the greatest impact on your account relationship with USALLIANCE.

As part of this transition, you should have received your new USALLIANCE member number and account numbers. If you have not received this information, please contact Member Services.

Members should have received a printed version of their September 2023 monthly statement in the mail. Statements were mailed via the USPS after October 5, 2023. Members who typically see their statements within digital banking will be able to view their eStatement starting in November with their October statement period. Transaction history prior to October 2023 will not appear in USALLIANCE digital banking.

Your replacement Visa® debit cards were mailed prior to conversion and should have arrived the week of September 18. If you have not received your debit card, please contact Member Services.

Activation directions can be found on a sticker placed on the front of the card. For joint accounts, each debit cardholder will have a unique card number. This is a security measure should one of the cards become lost, stolen, or otherwise compromised.

The Routing number for USALLIANCE is 221981063. Effective October 1 and going forward, please use this number (221981063) when setting up automatic payments.

If you have not done so already, please contact your direct deposit issuers (employer, Social Security, etc.) at your earliest convenience to provide them with your new USALLIANCE account and routing number. Deposits made using your MEFCU account and routing numbers received after October 1 may experience a slight processing delay.

If you receive direct deposits from Social Security, please contact their offices at (800) 772-1213 after October 1 to update your account information.

For any automatic payments you may have, you will be required to update your account number(s) and routing number to your new USALLIANCE information on or after October 1.

Effective October 1, 2023, automatic payments using MEFCU account number(s) or routing numbers may result in delayed processing.

MEFCU’s Online Banking platform will no longer be available after September 28. Beginning on October 1, you will have access to USALLIANCE Digital Banking.

If you previously used MEFCU's Online Banking Platform, you will be able to sign in for the first time using your username and password. If you are new to online banking, please register for Digital Banking by visiting usalliance.org on or after October 1. This process will take less than 5 minutes. We have made every effort to preserve your existing username, but you may be prompted to create a new one upon registration.

You may utilize the USALLIANCE telephone banking system, Dial-Up, beginning October 1. For initial access, your default password will be set as the last 4 digits of your Social Security Number. Immediately upon access, you will be prompted to change that password to one of your own choosing. Please note that check withdrawals are not available through Dial-Up. You may request a check withdrawal by calling Member Services at (800) 431-2754.

Yes. Your funds remain safe and secure at all times. Accounts continue to be insured by the National Credit Union Administration for up to $250,000 per member.

No. You will only have one member number per Social Security Number (or Tax ID number for businesses). All your accounts will be viewed under this number.

Please view the USALLIANCE fee schedule for all information on fees.

221981063

Members can make cash and check deposits at USALLIANCE branches, shared branch locations, and designated deposit-taking ATMs. Additionally, check deposits can be made via Digital Banking mobile deposit and by mailing deposits to:

USALLIANCE Financial

411 Theodore Fremd Avenue, Suite 350

Rye, NY 10580-1410

Activation directions can be found on a sticker placed on the front of the card.

USALLIANCE does not utilize the Allpoint network. For surcharge free transactions, you can utilize an ATM that participates in the CO-OP network or any Citibank branch ATMs. Please visit our branch and ATM locator for the ATM nearest you.

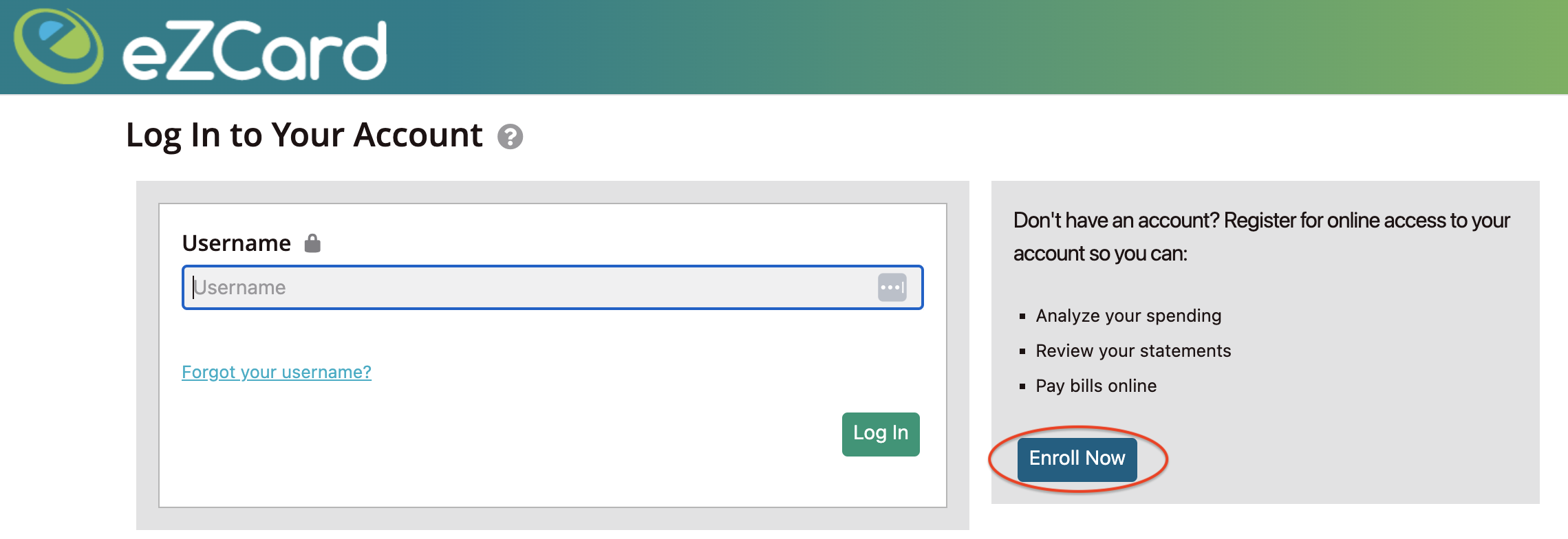

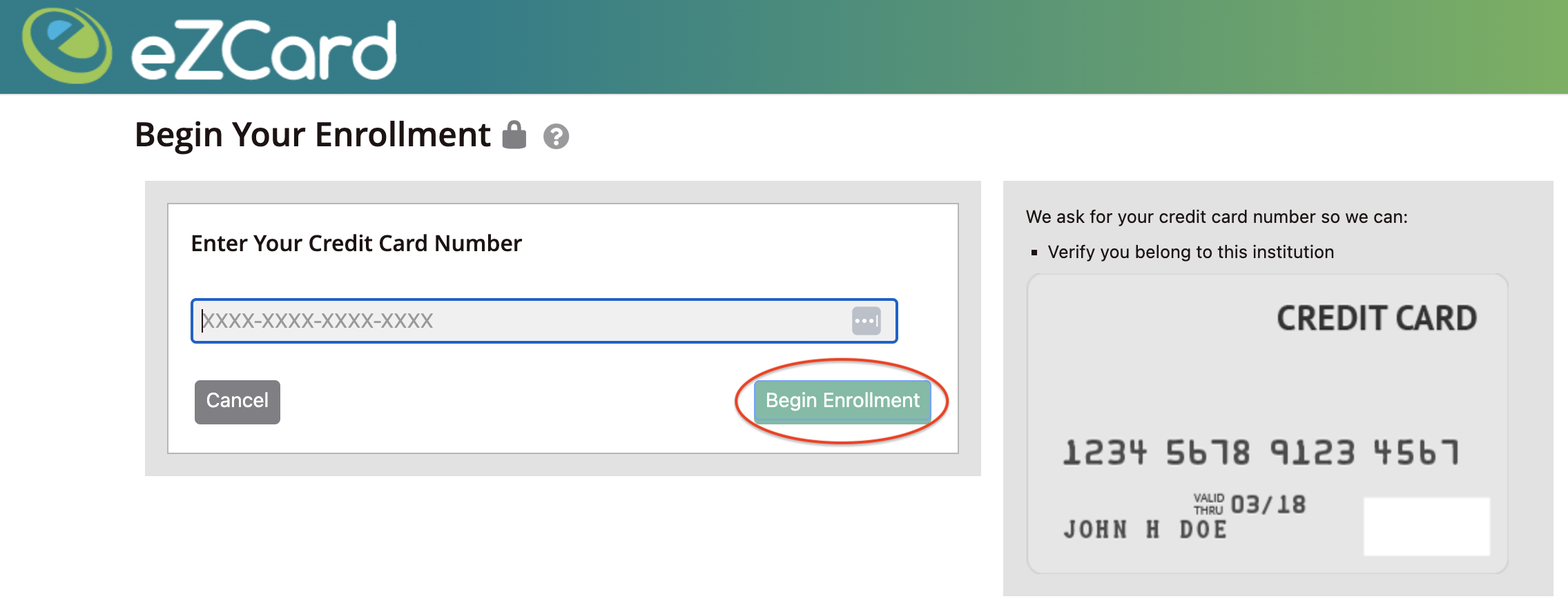

In order to register for online access to credit card account information, you must go to www.ezcardinfo.com and complete the following steps:

MEFCU credit card accounts will be converted later in 2024, at which time you will be reissued a USALLIANCE credit card in place of your existing MEFCU card.

MEFCU credit cards will convert to USALLIANCE in Spring 2024. We will transfer all your points to your new USALLIANCE credit card at that time.

One difference is that, currently, MEFCU reward points DO NOT expire and USALLIANCE reward points expire after three years. Once the points are converted in Spring 2024, all rewards points will expire after three years. Members will be informed of any additional changes as the credit card conversion date approaches.

No. Your loans will continue with the same terms and payments. However, your loan account numbers will change so any automatic payments from other institutions will need to be updated on or after September 29th.

USALLIANCE Financial

411 Theodore Fremd Avenue, Suite 350

Rye, NY 10580-1410

No. Beginning October 1, please call (800) 431-2754 to speak with Member Services. Representatives are available weekdays 7:30 AM to 8:00 PM ET and Saturdays 9:00 AM to 3:00 PM ET. You may also utilize the Live Chat service on our website to communicate directly with a knowledgeable Member Services Representative during the same hours. Your PIN will be the last four digits of your SSN.

No. The MEFCU website will no longer be available after conversion. As of October 1, account access, online applications and other important product and service resources will transition to usalliance.org.

Yes, you will have to register for USALLIANCE Digital Banking by visiting usalliance.org.

To register, you will need the following information:

We have made every effort to preserve your existing username, but you may be prompted to create a new one upon registration.

If you are prompted to create a new username and password, please follow the guidelines below.

Username must:

Password must:

No. Only activity from October 1, 2023 forward will be accessible in Digital Banking.

Yes. You can access the USALLIANCE 24-hour Dial-Up telephone banking service by calling (800) 431-2754 and selecting option 2.

You can use Dial-Up telephone banking to:

Please note that check withdrawals are not allowed through Dial-Up. You may request a check withdrawal by calling Member Services at (800) 431-2754.

![]()

USALLIANCE Financial is a full-service credit union that offers a wide range of banking services. We develop and implement custom-made, secure, and innovative products for many great organizations, in addition to our 150,000+ members worldwide.

| Live Life Fully Foundation | |

| Coral Labs | |

| USASpecialty Lending |

©2025 USAlliance Federal Credit Union. All rights reserved.

USAlliance Federal Credit Union d/b/a USALLIANCE Financial

![]() NMLS #562301 Equal Housing Lender

NMLS #562301 Equal Housing Lender

You are about to enter a website hosted by an organization separate from USALLIANCE. Privacy and security policies of USALLIANCE will not apply once you leave our site. We encourage you to read and evaluate the privacy policy and level of security of any site you visit when you enter the site. While we strive to only link you to companies and organizations that we feel offer useful information, USALLIANCE does not directly support nor guarantee claims made by these sites.